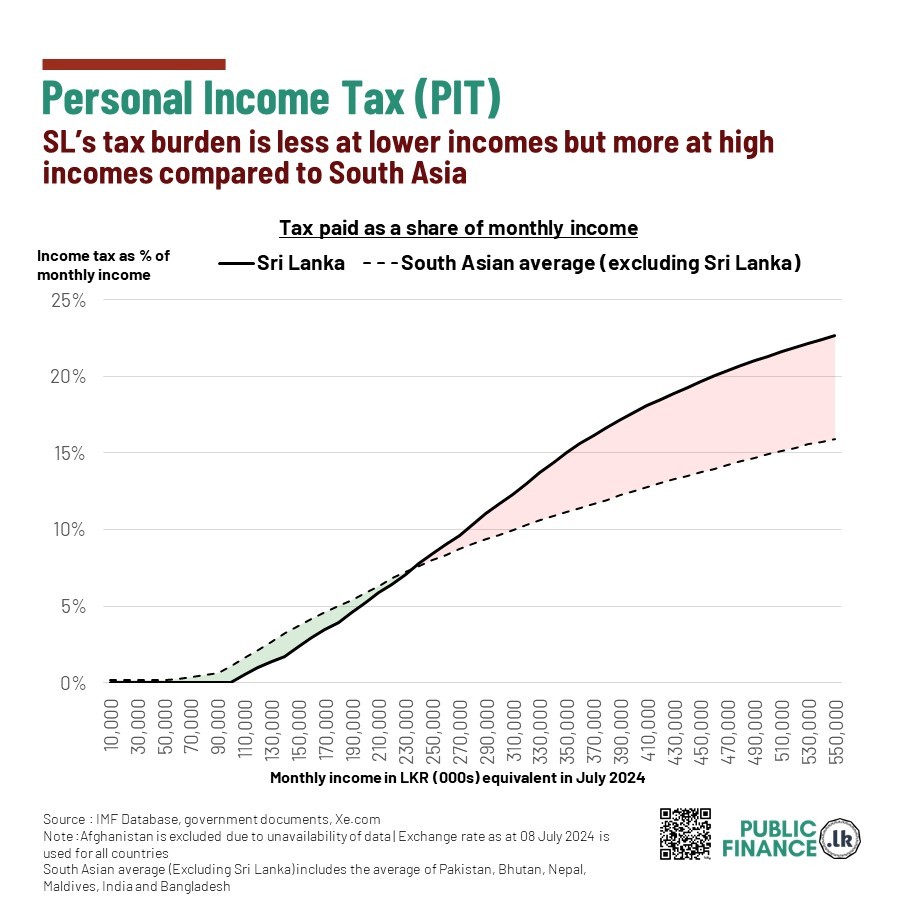

Sri Lanka's personal income tax burden varies significantly between lower and higher income levels. At lower incomes, particularly for those earning below LKR 250,000 per month, the tax burden—measured as the percentage of income paid in taxes—is lighter than in other South Asian countries. For example, individuals earning LKR 150,000 in Sri Lanka pay just 2% of their income as taxes, while the rest of South Asia, on average, pays 4%. However, beyond this income level, the tax burden rises steeply. For incomes exceeding LKR 250,000 per month, Sri Lanka’s tax burden increases more rapidly than its regional peers, making it one of the highest in South Asia. At an income level of LKR 500,000, Sri Lanka’s tax burden is much higher at 21%, compared to the South Asian average of 15%. However, it is still below the tax burden of Pakistan (22%) and Nepal (23%).

Ultimately, Sri Lanka's personal income tax system places the country in a distinct position within South Asia. On one hand, it offers substantial relief to low-income earners with its high tax-free threshold. On the other hand, it imposes a steep tax burden on high-income earners, far more quickly than its neighbours.