Dr. Sharmini Coorey is a non-resident fellow at Verité Research. She was a former Department Director at the International Monetary Fund (IMF) and currently a member of the Presidential Advisory Group on multilateral engagement and debt sustainability advising the Government of Sri Lanka.

With the prospect of elections this year, political parties are gearing up their rhetoric and policy promises to an electorate worn out by two years of economic crisis on top of the hardship imposed by two years of a global pandemic. Reckless policies in 2020-21 forced Sri Lanka to declare a debt default, drove inflation to a peak of over 70 percent in September 2022, and contracted GDP by over a cumulative 11 percent in 2022-23. The CBSL has since succeeded in stabilizing inflation at low single digits and building up international reserves while embarking on a program to strengthen a banking system battered by the preceding economic shocks. Output is showing signs of recovery, with growth turning slightly positive in the third quarter of 2023 and tourism picking up. Sri Lanka has reached a debt restructuring agreement in principle with official bilateral creditors and good faith discussions with international bond holders are proceeding. With these signs of a long-awaited turnaround, it may be tempting to believe that the reforms are largely done and policies can be relaxed.

Declaring a premature victory has been Sri Lanka’s playbook and must not be repeated, especially this election year and aftermath. During previous economic difficulties, we did not implement difficult structural and governance reforms once some degree of macroeconomic stabilization was achieved. This stop-and-go policymaking and fiscal indiscipline resulted in a high government debt ratio even before the pandemic (70-90 percent of GDP in most years during 1980-2019). But this time really is different because our starting point—with a debt default and a public debt ratio of 126 percent of GDP—is so much worse.

What will Sri Lanka’s debt restructuring deliver?

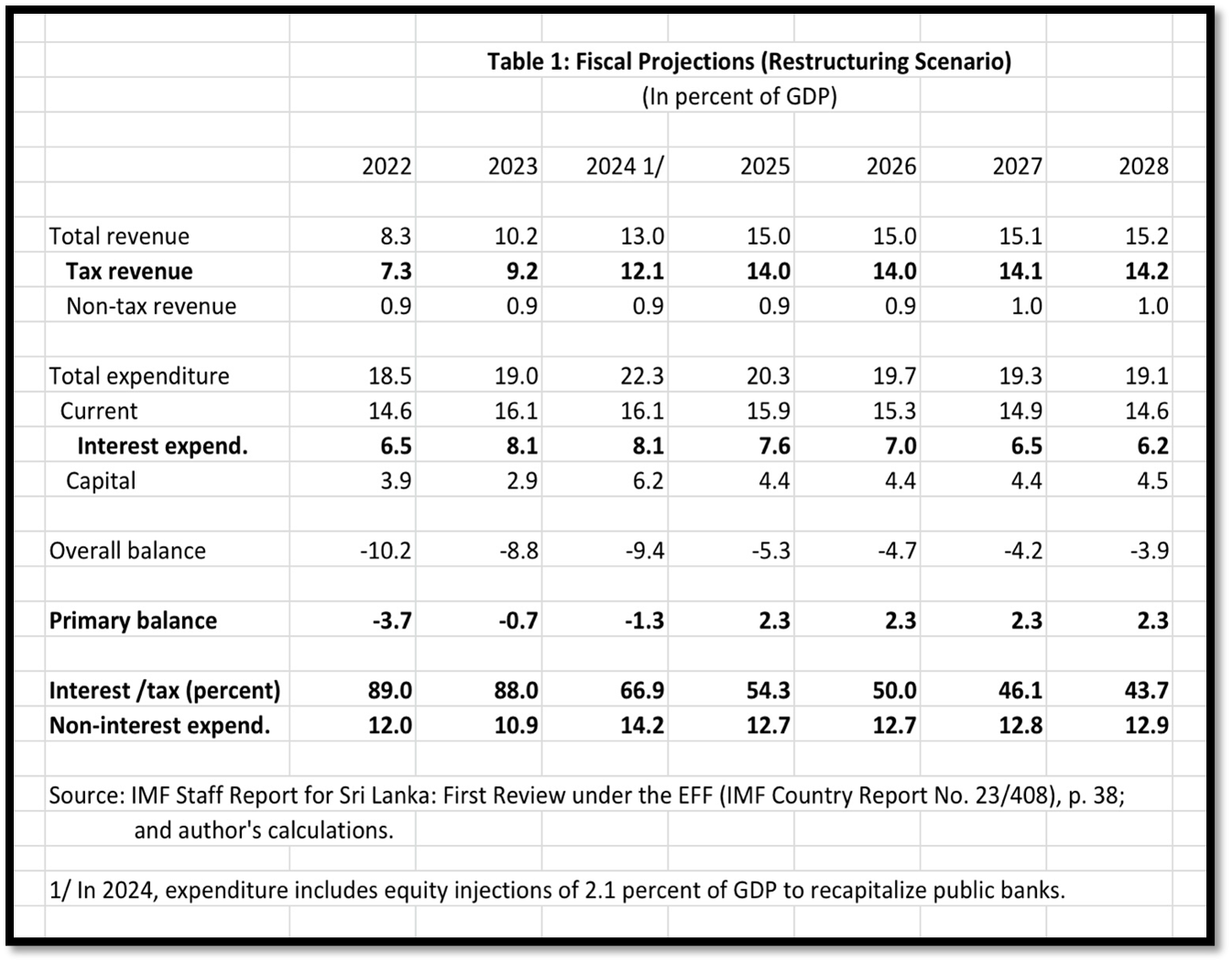

The basis for all international debt restructuring, including Sri Lanka’s, is the IMF’s Debt Sustainability Analysis (DSA). Based on the IMF’s macroeconomic assumptions and policies agreed under the government’s IMF-supported program, the DSA projects the country’s debt and debt service over the coming decade and beyond. After taking into account the maximum fiscal adjustment that the IMF judges the country can realistically sustain, it shows the amount of debt relief that creditors must provide to make the country’s debt sustainable. In Sri Lanka’s case, the government is required to run a surplus of 2.3 percent of GDP on its primary fiscal balance (i.e., the fiscal balance excluding interest payments) every year from 2025 until at least 2035. The DSA sets out the following criteria that a debt restructuring must meet:

Even with a successful debt restructuring, there is no margin for policy errors or delays

The DSA shows that even after debt restructuring, Sri Lanka will be vulnerable to debt distress and face a tight fiscal situation over the next decade. Consider:

These considerations are not a matter of ideology. They are a matter of arithmetic. Sri Lanka’s tight fiscal situation and vulnerability to another bout of debt distress will remain whatever political ideology one espouses and whether or not we have an IMF-supported program. (It would be considerably worse without the IMF). Policy reversals—like lowering taxes—or delays in implementing structural reforms will only make matters worse. If political parties want a better outcome, they need to adopt policies that will deliver it. Part II of this article will offer some suggestions.