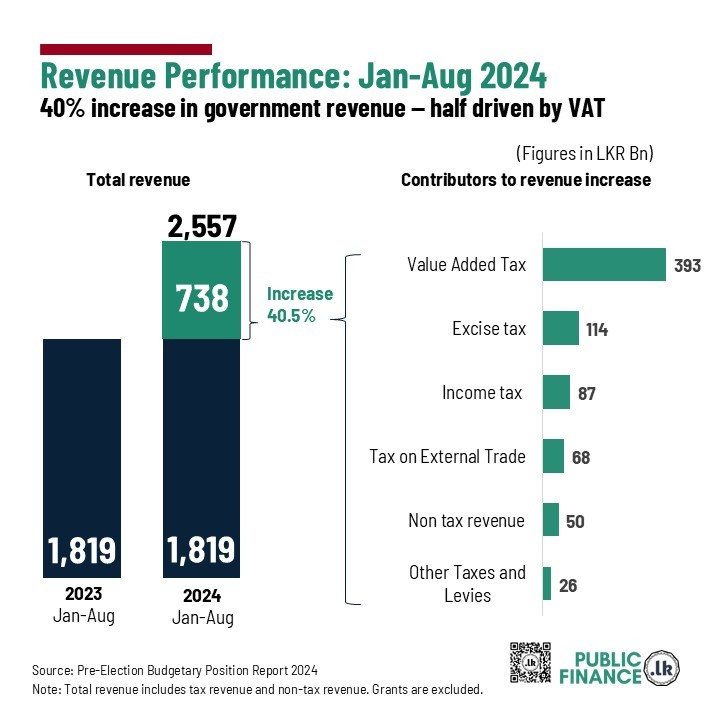

During the first eight months of 2024, government revenue rose from LKR 1,819 billion to LKR 2,557 billion compared to the same period in the previous year.

This increase arises from high revenue growth across all major tax categories, with VAT being the main contributor. VAT collections rose by 87% from LKR 450 billion in 2023 to LKR 842.5 billion in 2024, contributing over half of the overall revenue increase.

Key factors behind this growth are (i) an increase in the VAT rate from 15% to 18%, (ii) the removal of VAT exemptions on 95 out of 137 major items and (iii) a reduction in the VAT registration threshold from LKR 80 million to LKR 60 million.

Excise taxes added an additional LKR 114 billion, which was an increase of 42%; of which the major share -- LKR 80.6 billion – came from the increase in Excise taxes on petroleum products. For further details on fuel tax changes, explore our Fuel Price Tracker.

Non-tax increased by 31.7% and accounted for nearly 7% of the overall revenue growth.

Exhibit 1: Government Revenue 2023-2024(Jan-Aug)

|

Item |

2023 (Jan-Aug) |

2024 (Jan-Aug) |

Growth |

Contribution to growth % |

|

Total revenue |

1,819,990 |

2,557,792 |

40.5% |

100% |

|

Value Added tax |

449,981 |

842,487 |

87.2% |

53.2% |

|

Excise tax |

271,675 |

385,740 |

42.0% |

15.5% |

|

Income Tax |

537,175 |

624,670 |

16.3% |

11.9% |

|

Tax on External Trade |

234,518 |

302,517 |

29.0% |

9.2% |

|

Non-tax revenue |

158,838 |

209,263 |

31.7% |

6.8% |

|

Other Taxes and Levies |

167,804 |

193,114 |

15.1% |

3.4% |

Note

Total revenue includes tax revenue and non-tax revenue. Grants are excluded.

Source

Ministry of Finance 'Pre-Election Budgetary Position Report' at https://www.treasury.gov.lk/api/file/058b7da9-293a-4cba-8569-9b850a332342 [last accessed 24 October 2024].

Ministry of Finance 'Annual Report 2023’ at https://www.treasury.gov.lk/api/file/ad12f7fa-d2db-43d4-9daa-9270ee7b7cac [last accessed 24 October 2024].