On May 22, 2024, the government of Sri Lanka gazetted the Public Financial Management (PFM) Bill, aiming to implement wide-ranging reforms to enhance transparency, accountability and control of public funds.

The bill includes several improvements over the current Fiscal Management (Responsibility) Act, No. 3 of 2003 (FMRA), previously recommended by Verité Research. These included improvements to the FMRA such as (a) improving information disclosure, (b) mandating the publication of analysis supporting budget proposals and estimates and (c) capping discretionary spending by limiting the line item that gives excessive allocative discretion, to 2 percent of the budget.

Despite these improvements, there are significant shortcomings as well. One of them is the replacement of the current budget balance limit in the FMRA with a limit on primary expenditure at 13 percent of gross domestic product (GDP).

The PFM bill specifies, “The primary expenditure of the government shall not exceed 13 per centum of the estimated nominal gross domestic product for the relevant financial year.” [section 15(1)].

This means that the annual government expenditure, excluding interest payments on debt, must be within 13 percent of GDP, regardless of the revenue levels. The bill also repeals the existing budget balance rule of a negative 5 percent of GDP in the FMRA.

This insight shows that the change is exceptional in two ways. First, empirically, it would make Sri Lanka a global outlier – both for having a GDP-based primary expenditure limit and for setting it at the lowest level in the world. Second, theoretically, it would make Sri Lanka adopt a principle that is at odds with established economic reasoning.

Empirical exception: Makes Sri Lanka a global outlier in two ways

1. Primary expenditure limit: A rare practice in fiscal rules

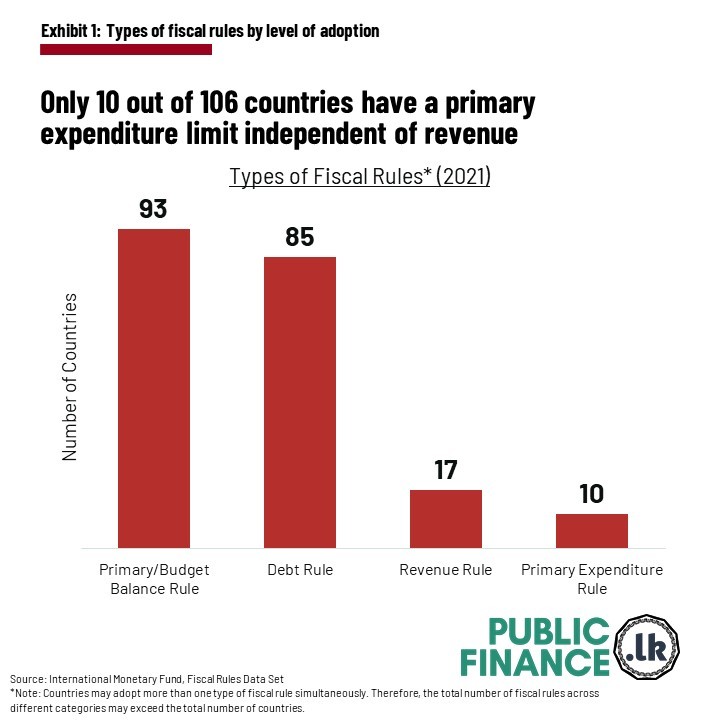

Most countries that adopt fiscal rules allow a rational rule that allows expenditure to increase in line with revenue. These rules typically limit the deficit through the primary balance or the entire budget balance or by imposing a debt limit. A GDP-based primary expenditure limit is rare. According to the International Monetary Fund’s (IMF) fiscal rules database, which includes 106 countries, only 10 have a rule that limits primary expenditure independently of revenue (See Exhibit 1).

2. Most extreme limit

Among the 10 countries with a primary expenditure rule not tied to revenue, none have a limit as low as what is proposed for Sri Lanka. Exhibit 2 shows that these 10 countries have much higher limits, as their primary expenditure is allowed to grow with nominal GDP or inflation– keeping the share of GDP effectively the same or lower. In some cases, the primary expenditure level exceeds 50 percent of GDP. Seven of these countries have a primary expenditure limit above 30 percent of GDP, while the remaining three range between 20-30 percent of GDP.

At 13 percent, the proposed limit for Sri Lanka would be the most extreme globally. Currently, the lowest limit is for Paraguay at 21.8 percent, which is more than one and a half times the proposed limit for Sri Lanka.

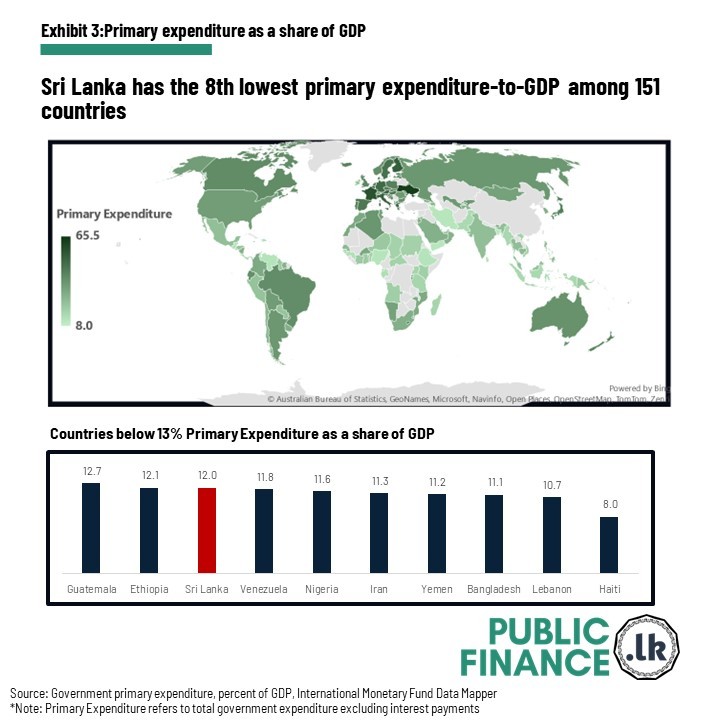

According to the IMF’s Primary Expenditure database, only 10 out of 151 countries had a primary expenditure below 13 percent of GDP in 2022. Successful economies can have high levels of primary expenditure, such as France, Japan, the UK and China, which have primary expenditure levels of 56.6 percent, 48.8 percent, 40.3 percent and 32.5 percent of their GDP, respectively. Countries with a lower per-capita than Sri Lanka also spend more than 13 percent of their GDP on primary expenditure. For instance, 33.2 percent in Bhutan and 23.4 percent in India (See Exhibit 3).

Theoretical exception: Policy at odds with orthodox economic theory

The purpose of government expenditure is to enhance present and future social welfare, which is the principal objective of economic policy. To achieve this in a sustainable manner, economic theory supports fiscal rules that manage deficits and debt. That means fiscal rules on expenditure are normally tied to revenue. Limiting primary expenditure independent of revenue and tying it to GDP, as proposed for Sri Lanka, runs counter to what can be supported by microeconomic and macroeconomic theory.

Microeconomics-based theory on public expenditure

There are three main categories of efficiency and welfare-improving reasons in microeconomic theory that justify increasing primary expenditure, provided it is supported by revenue expansion.

(i) Correcting for externalities: Market failures exist when the value of a transaction to society is not internalised in the price. Correcting for this ‘neglected value’ is a function of the government. For example, there is an economic case for subsidising vaccines or public transport as it allows the consumption of these goods to increase in line with more efficient social outcomes – because vaccinated people provide protection to other people and using public transport reduces congestion delays for others.

(ii) Providing public goods: Certain goods have characteristics that economists refer to as non-contestability or non-excludability, which create coordination and decision problems that prevent private markets from delivering them at efficient levels. For example, parks, roads and street lighting

(iii) Social redistribution: Redistributing resources from the much better off to the much worse off improves total social welfare, which is the main task of economics. This is because small redistributions have higher marginal welfare consequences for the poorest. This can be achieved through tax-funded social safety nets as well as the provision of healthcare and education for those who cannot afford it otherwise.

Macroeconomics-based theory on public expenditure

Both neoclassical and neo-Keynesian economic models support the expansion of primary expenditure for economic benefit, provided that such expansion is supported by revenue.

Neoclassical theories differ from the Keynesian approach in that they advocate for maintaining economic stability during short-term fluctuations around business cycles through monetary policy rather than fiscal policy.

Within neoclassical reasoning, well-established long-term growth theories, such as the Human-Capital-Augmented Solow model by Mankiw, Romer and Weil (1992), identify investments in physical and human capital, as well as technology, as the key drivers of sustainable economic growth.

Other endogenous growth models also highlight the need for government spending on physical infrastructure such as roads, bridges and public utilities to enhance the environment for economic activities by reducing transaction costs and improving market access. Investments in education and training are crucial for developing a skilled workforce necessary for innovation and growth (Jones & Manuelli, 2005). Additionally, government funding for R&D is a key driver to stimulate technological advancements and drive innovation, which in turn fosters economic competitiveness (Aghion & Howitt, 2005).

Meanwhile, the Keynesian approach advocates for actively stabilising the economy by increasing government spending (and reducing taxes) when the economy is below full output and vice versa.

Hence, it is not possible to draw on either of these approaches to support the policy of an exceptionally low GDP-based limit on primary expenditure that is not tied to revenue, as proposed in the PFM bill.

A low absolute limit on primary expenditure harms economic prospects

Limiting primary expenditure at such low levels can harm welfare, productivity and growth. Studies by Ospina and Roser (2016) have shown a positive correlation between a country’s income and its expenditure share of GDP. This indicates that as a country’s income increases, the expenditure share of GDP also rises, supporting sustained growth.

Advanced economies, which spend around 43 percent of their GDP on primary expenditures, have achieved enhanced social welfare and economic growth through such spending. Emerging economies also spend around 28 percent of their GDP on primary expenditure. Historically, Sri Lanka, too, had primary expenditures ranging from 20-30 percent of GDP, while revenue exceeded 20 percent of GDP.

Currently, public sector costs and welfare spending (including health and education) take up around 8-10 percent of GDP. An expenditure limit of 13 percent could crowd out capital expenditure, as seen under repeated fiscal consolidation efforts in Sri Lanka. In its latest review, the IMF emphasised the importance of reducing the reliance on ad hoc cuts to capital expenditure, noting its detrimental effects on growth. Therefore, an expenditure limit that is not tied to revenue is likely to harm the growth potential both in the present and future.

Overall, established economic reasoning suggests that this proposed limit would adversely restrict the government’s ability to spend, particularly on investments in human and physical capital, which are crucial for promoting growth, productivity, efficiency and social welfare in the future.

An alternative approach: A budget/primary balance rule

In contrast to the GDP-linked primary expenditure limit, a budget or primary balance rule, which ties expenditure to government revenue, allows for the expansion of public goods and social welfare without compromising fiscal prudence and sustainability. Such a rule would ensure that any increase in expenditure is matched by a corresponding increase in revenue, maintaining fiscal discipline while fostering economic growth and social welfare.

Exhibit 2: Countries with a GDP linked primary expenditure limit

|

Country |

Primary Expenditure Limit as a % of GDP set to increase in step with: |

Primary Expenditure as a % of GDP |

|

Finland |

Inflation rate (for primary non-cyclical expenditure) |

52.5% |

|

Belgium |

Inflation rate |

52.0% |

|

Brazil |

Inflation rate |

38.3% |

|

Ecuador |

Long Term Real GDP growth |

37.7% |

|

Andorra |

Positive Nominal GDP growth |

35.5% |

|

Argentina |

Positive Nominal GDP growth or Inflation (if negative growth) |

35.2% |

|

Grenada |

Inflation rate |

30.6% |

|

Uruguay |

Potential Real GDP growth |

27.8% |

|

Mexico |

Potential Real GDP growth – which is 2% |

23.2% |

|

Paraguay |

Inflation rate + 4% |

21.8% |

Source: IMF Fiscal Rules Dataset

Link to the original article published on the Daily Mirror Column.