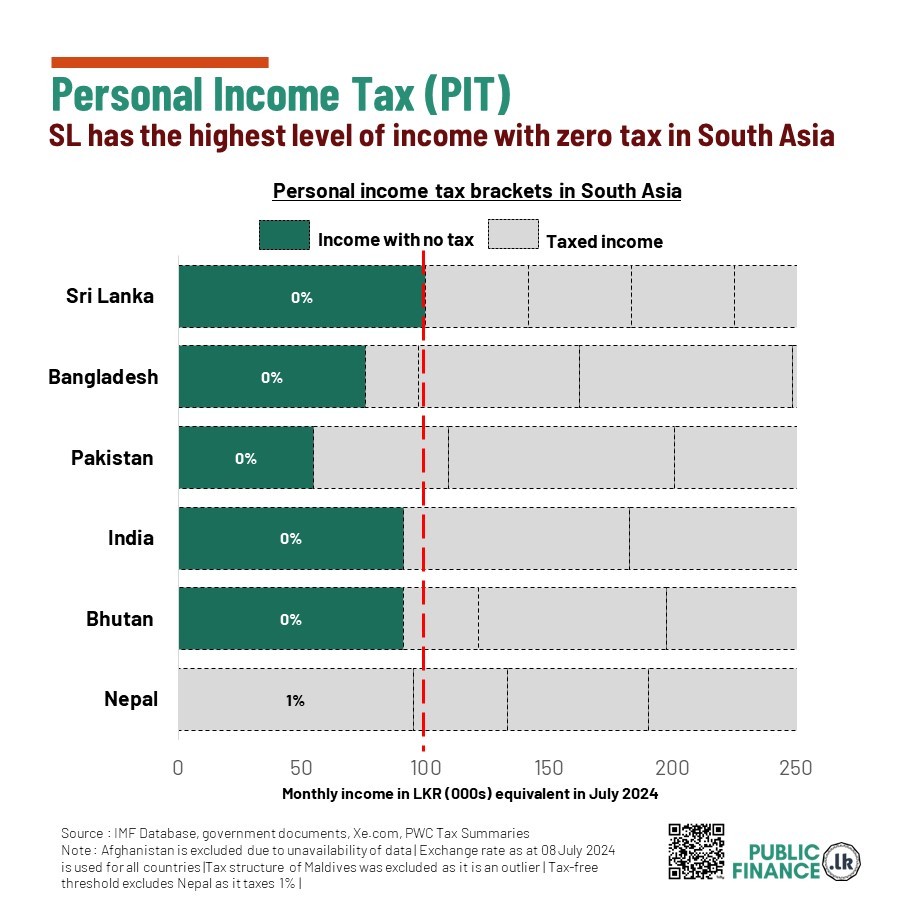

Sri Lanka has the highest tax-free income threshold in South Asia – without the Maldives. Citizens are exempt from paying income tax unless they earn over LKR 1.2 million annually (LKR 100,000 per month). In comparison, neighbouring countries have much lower thresholds. Bangladesh's monthly tax-free threshold is equivalent to LKR 75,682, while Pakistan’s is LKR 54,710. India and Bhutan have thresholds of around LKR 91,000, slightly lower than Sri Lanka. Nepal stands out as an outlier with no tax-free income threshold, imposing a 1% tax even on the lowest income earners. Sri Lanka’s generous tax-free allowance makes it one of the more taxpayer-friendly countries in the region, at least for those at the lower end of the income scale who are exempt from paying taxes.

Table 1: Tax free income threshold in South Asia (local currency and LKR equivalent)

|

Country |

Annual Tax-free threshold in Local Currency |

Monthly Tax-free threshold in Local Currency |

LKR equivalent of Monthly Tax-free threshold* |

|

Sri Lanka |

LKR 1,200,000 |

LKR 100,000 |

LKR 100,000 |

|

Bangladesh |

BDT 350,000 |

BDT 29,167 |

LKR 75,682 |

|

Pakistan |

PKR 600,000 |

PKR 50,000 |

LKR 54,710 |

|

India |

INR 300,000 |

INR 25,000 |

LKR 91,310 |

|

Bhutan |

BTN 300,000 |

BTN 25,000 |

LKR 91,107 |

|

Nepal |

0 |

0 |

0 |

|

Maldives |

MVR 720,000 |

MVR 60,000 |

LKR 1,183,248 |