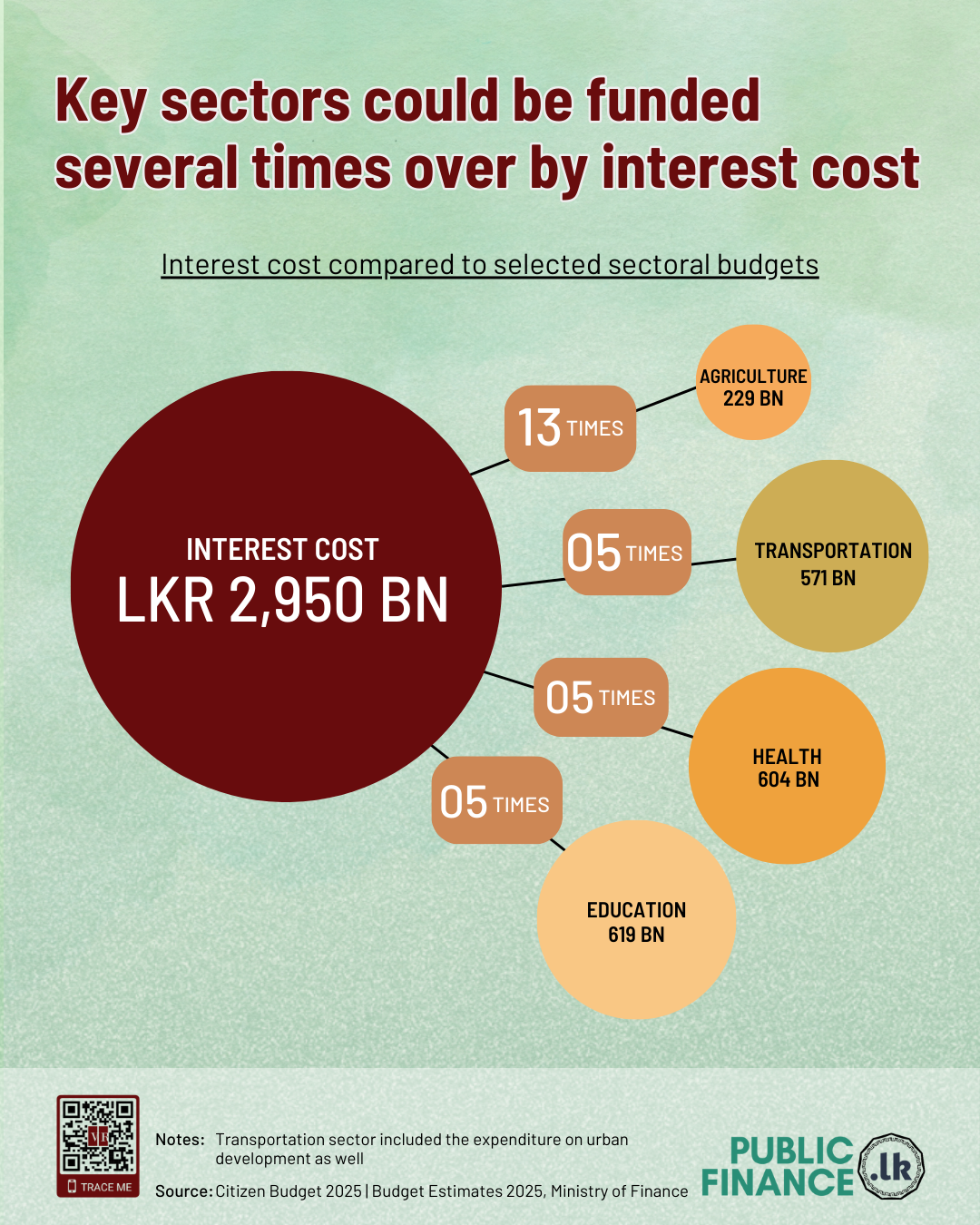

In budget 2025, LKR 2,950 billion (8.9% of GDP) has been allocated for interest payments on public debt. Government revenue is estimated at LKR 4,990 billion in 2025, nearly 60% of which will be spent on servicing just the interest payments on debt.

Comparison of Interest Cost with Key Tax Revenues in 2025

To put this in context, tax revenues from VAT, Excise Tax, Social Security Contribution Levy, Withholding Tax, and PAYE are expected to generate LKR 2,860 billion (62% of total tax revenue ). Even all of this covers only 97% of total interest expenditure.

Comparison of Interest Costs with Essential Service Spending in 2025

A comparison with other government expenditure shows that interest costs are

Historical trend

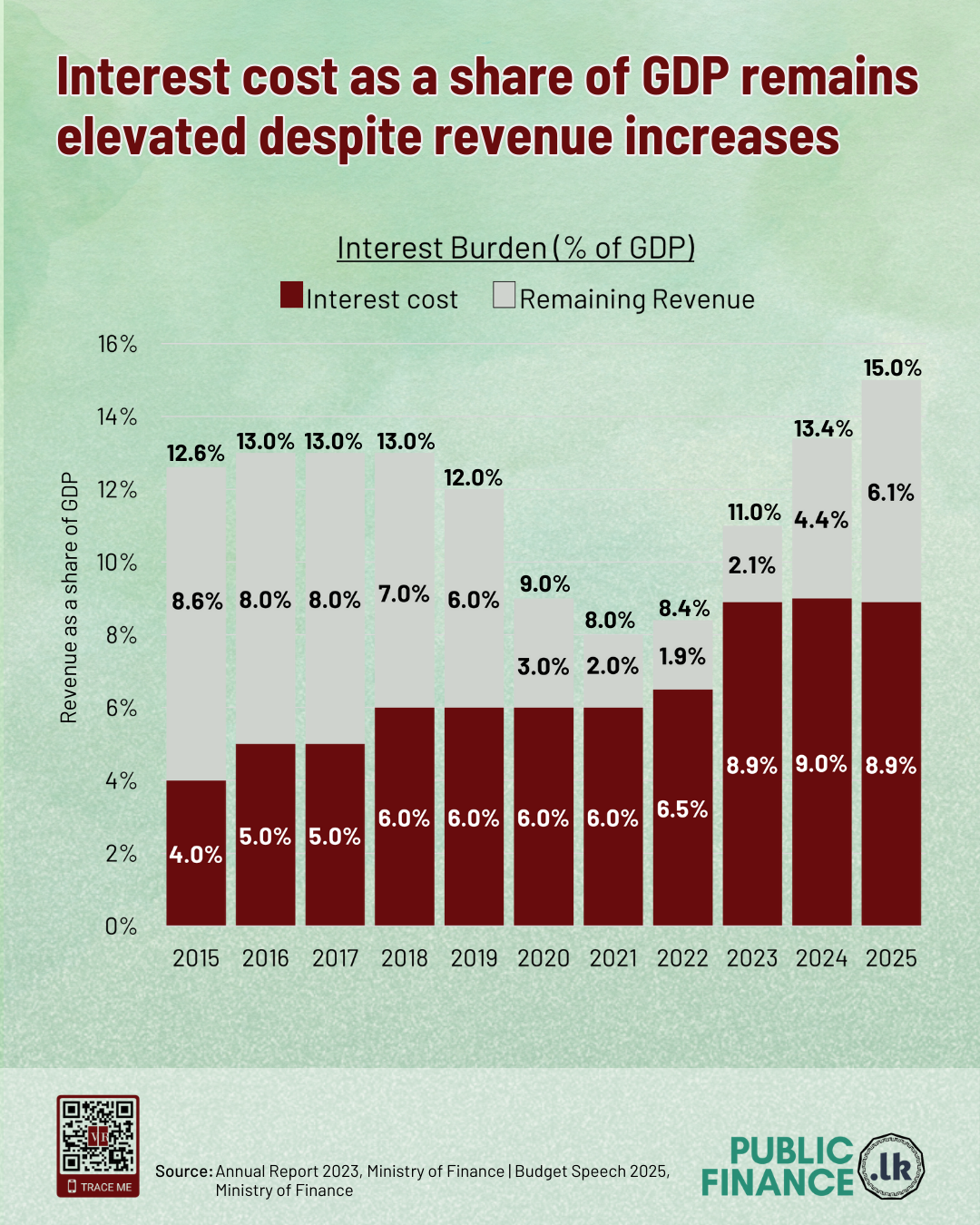

Since 1990, Sri Lanka’s interest-to-revenue ratio has consistently been among the highest 10 countries in the world. . In 2023, this ratio peaked at 80%. It has declined since due to a large increase in revenue. In 2024, revenue increased by 33%, while interest costs increased by only 10%.

The interest cost projected in the 2025 budget is 59%. This projection is based on a revenue increase of LKR 899 billion, while interest payments are expected to increase by LKR 260 billion.

Despite the interest-to-revenue ratio reducing from the peak of 80% in 2023, as a share of GDP it remains elevated. In 2023 interest cost rose to a record peak of 8.9% as a share of GDP. It will be at the same level in 2025 as well.

Sources

Ministry of Finance, Sri Lanka 'Detailed Draft Budget Estimates 2025' at https://www.treasury.gov.lk/web/detailed-draft-budget-estimates-2025/section/2025 [last accessed 19 February 2025]

World Bank ‘Interest Payments: Percent of Revenue’ at https://data.worldbank.org/indicator/GC.XPN.INTP.RV.ZS [last accessed 3 March 2025].

Research By: Sadini Galhena, Anushan Kapilan

Visualisation By: Chamelie Epa