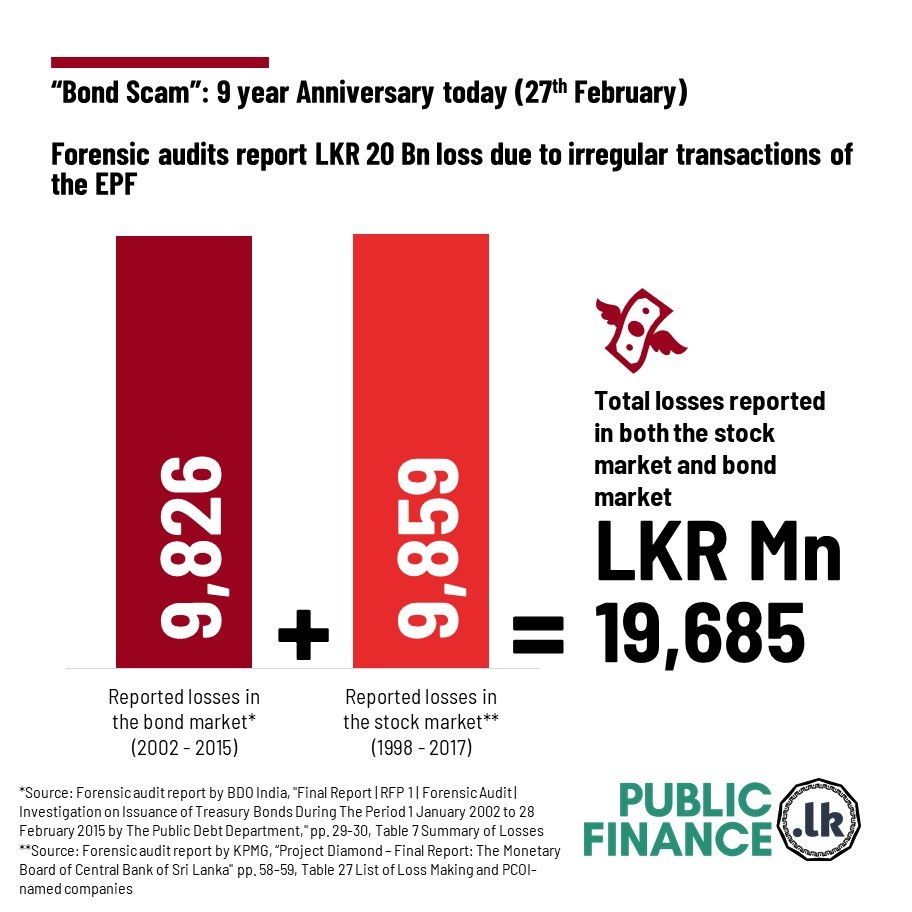

The 27th of February marks nine years since the infamous “bond scam” of 2015. This resulted in a forensic audit, completed in 2019, on activities of the Central Bank of Sri Lanka (CBSL) with regard to bond market auctions and irregular transactions of the EPF, which is Sri Lanka's largest superannuation fund that is also managed by the CBSL.

The forensic audits report nearly Rs. 10 billion (Rs. 9,826 million) in in losses to the EPF due to irregular bond market transactions from 2002 to 2015. They also report irregular transactions in the share market resulting in losses to the EPF amounting to Rs. 9,470 million in listed equity and Rs. 389 million in unlisted equity from 1998 to 2017. These losses, stemming from irregular transactions in both the bond market and the share market, amount to nearly Rs. 20 billion!