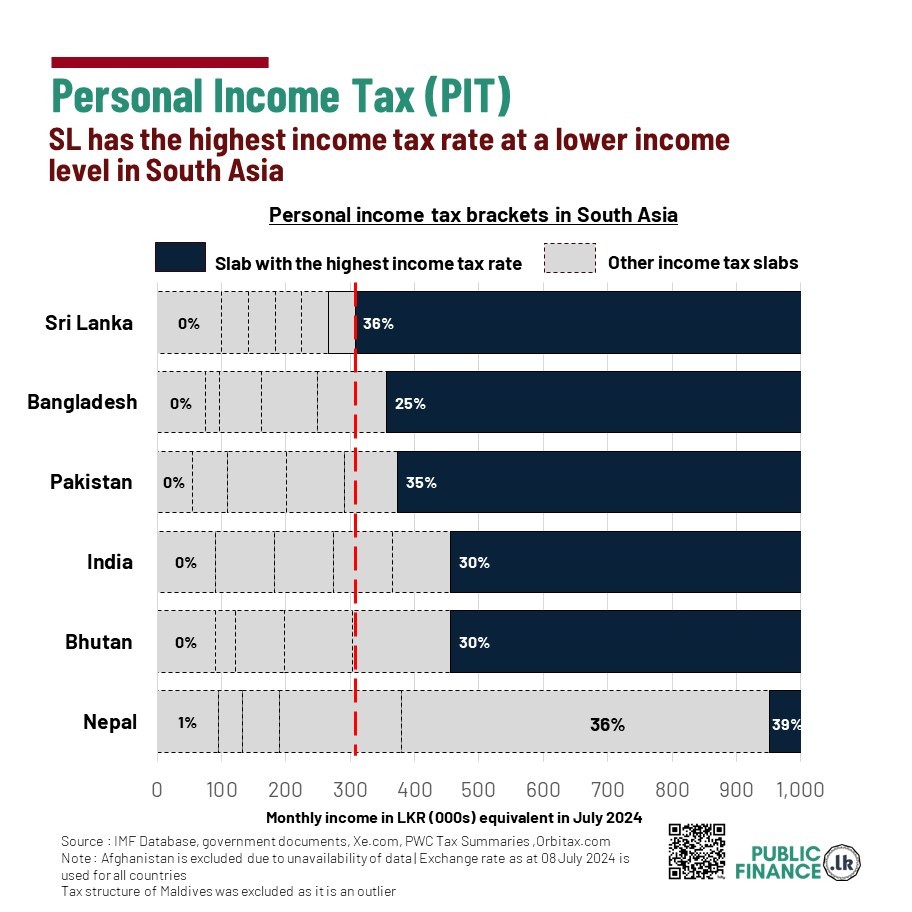

The comparison of Sri Lanka’s personal income tax structure with its South Asian peers reveals three key findings. One, Sri Lanka has the highest tax-free income - that is, the minimum income before taxes are applied. Two, Sri Lankans are charged the top tax rate—that is, the highest rate of income tax in the tax schedule—at a lower income. Three, Sri Lanka’s tax burden is relatively lower at lower income levels (individuals earning below LKR 250,000 per month) but higher at higher income levels (above LKR 250,000).

Background

In 2023, Sri Lanka reformed its personal income tax structure through the Inland Revenue (Amendment) Act, No. 45 of 2022, with the aim of increasing revenue collected through personal income taxes. These reforms included the reduction of the tax-free threshold from LKR 3.0 million (LKR 250,000 per month) to LKR 1.2 million annually (LKR 100,000 per month), the reduction of the tax slab from LKR 3.0 million to LKR 500,000 per annum, and increasing tax rates up to 36%, from the previous maximum of 18%.

As a result, personal income tax revenue surged from LKR 49.5 billion in 2022 to LKR 193.5 billion in 2023, nearly quadrupling in value.

The personal income tax structure currently applicable in Sri Lanka is shown in Exhibit 1.

Exhibit 1: Personal income tax schedule as of September 2024

|

Annual Income |

Monthly Income |

|

||

|

Lower Boundary |

Upper Boundary |

Lower Boundary |

Upper Boundary |

Tax Rate (%) |

|

0 |

1,200,000 |

- |

100,000 |

0% |

|

1,200,000 |

1,700,000 |

100,000 |

141,667 |

6% |

|

1,700,000 |

2,200,000 |

141,667 |

183,333 |

12% |

|

2,200,000 |

2,700,000 |

183,333 |

225,000 |

18% |

|

2,700,000 |

3,200,000 |

225,000 |

266,667 |

24% |

|

3,200,000 |

3,700,000 |

266,667 |

308,333 |

30% |

|

3,700,000 |

|

308,333 |

- |

36% |

Source : Inland Revenue Department of Sri Lanka, at https://www.ird.gov.lk/en/sitepages/default.aspx [last accessed 3 September 2024].

Sri Lanka’s generous tax-free income threshold

Sri Lanka has the highest tax-free income threshold in South Asia, excluding the Maldives. Citizens are exempt from paying income tax unless they earn over LKR 1.2 million annually (LKR 100,000 per month). In comparison, neighbouring countries have much lower thresholds. Bangladesh's monthly tax-free threshold is equivalent to LKR 75,682, while Pakistan’s is LKR 54,710. India and Bhutan have thresholds of around LKR 91,000, slightly lower than Sri Lanka. Nepal stands out as an outlier with no tax-free income threshold, imposing a 1% tax even on the lowest income earners. Sri Lanka’s generous tax-free allowance makes it one of the more taxpayer-friendly countries in the region, at least for those at the lower end of the income scale who are exempt from paying taxes.

Sri Lanka’s quick climb to the top tax rate

Sri Lanka imposes its highest tax rate at a relatively lower income threshold compared to other South Asian countries. Individuals earning over LKR 308,333 per month are subject to a steep 36% tax rate, making Sri Lanka the fastest in the region to reach its top tax bracket - the highest tax rate at which income is taxed. In comparison, India and Bhutan apply their top tax rate of 30% on incomes around LKR 457,000 and LKR 456,000, respectively, while Pakistan’s 35% rate applies to incomes above LKR 374,000. Bangladesh, with a lower top tax rate of 25%, taxes incomes above LKR 357,000. Nepal, the only country with a higher top tax rate than Sri Lanka, charges 39% on incomes over LKR 950,958, while its 36% rate applies to earnings above LKR 381,000—still higher than Sri Lanka’s threshold.

Disparity in tax burden on lower and higher income levels

The analysis reveals a distinct pattern in Sri Lanka's personal income tax burden, which varies significantly between lower and higher income levels. At lower incomes, particularly for those earning below LKR 250,000 per month, the tax burden—measured as the percentage of income paid in taxes—is lighter than in other South Asian countries. For example, individuals earning LKR 150,000 in Sri Lanka pay just 2% of their income as taxes, while the rest of South Asia, on average, pays 4% (Includes the Maldives). However, beyond this threshold, the tax burden rises steeply. For incomes exceeding LKR 250,000 per month, Sri Lanka’s tax burden increases more rapidly than its regional peers, making it one of the highest in South Asia. At an income level of LKR 500,000, Sri Lanka’s tax burden is much higher at 21%, compared to the South Asian average of 15%. However, it is still below the tax burden of Pakistan (22%) and Nepal (23%).

Ultimately, Sri Lanka's personal income tax system places the country in a distinct position within South Asia. On one hand, it offers substantial relief to low-income earners with its high tax-free threshold. On the other hand, it imposes a steep tax burden on high-income earners, far more quickly than its neighbours.

Note on the Methodology used for the analysis

Additional Tables

Table 1: Tax free income threshold in South Asia (local currency and LKR equivalent)

|

Country |

Annual Tax-free threshold in Local Currency |

Monthly Tax-free threshold in Local Currency |

LKR equivalent of Monthly Tax-free threshold* |

|

Sri Lanka |

LKR 1,200,000 |

LKR 100,000 |

LKR 100,000 |

|

Bangladesh |

BDT 350,000 |

BDT 29,167 |

LKR 75,682 |

|

Pakistan |

PKR 600,000 |

PKR 50,000 |

LKR 54,710 |

|

India |

INR 300,000 |

INR 25,000 |

LKR 91,310 |

|

Bhutan |

BTN 300,000 |

BTN 25,000 |

LKR 91,107 |

|

Nepal |

0 |

0 |

0 |

|

Maldives |

MVR 720,000 |

MVR 60,000 |

LKR 1,183,248 |

Table 2: Annual tax rate schedules in South Asia (local currency and LKR equivalent)

|

Country |

Income Group (LKR Equivalent) |

Tax rate (%) |

|

|

Lower income boundry |

Upper income boundry |

||

|

Bangladesh |

0 |

908,180 |

0% |

|

908,180 |

1,167,660 |

5% |

|

|

1,167,660 |

1,946,100 |

10% |

|

|

1,946,100 |

2,984,020 |

15% |

|

|

2,984,020 |

4,281,420 |

20% |

|

|

4,281,420 |

|

25% |

|

|

Pakistan |

0 |

656,520 |

0% |

|

656,520 |

1,313,040 |

5% |

|

|

1,313,040 |

2,407,240 |

15% |

|

|

2,407,240 |

3,501,440 |

25% |

|

|

3,501,440 |

4,486,220 |

30% |

|

|

4,486,220 |

|

35% |

|

|

Maldives |

0 |

14,198,976 |

0% |

|

14,198,976 |

23,664,960 |

6% |

|

|

23,664,960 |

35,497,440 |

8% |

|

|

35,497,440 |

47,329,920 |

12% |

|

|

47,329,920 |

|

15% |

|

|

Bhutan |

0 |

1,093,287 |

0% |

|

1,093,287 |

1,457,716 |

10% |

|

|

1,457,716 |

2,368,789 |

15% |

|

|

2,368,789 |

3,644,290 |

20% |

|

|

3,644,290 |

5,466,435 |

25% |

|

|

5,466,435 |

|

30% |

|

|

Nepal |

0 |

1,141,150 |

1% |

|

1,141,150 |

1,597,610 |

10% |

|

|

1,597,610 |

2,282,300 |

20% |

|

|

2,282,300 |

4,564,600 |

30% |

|

|

4,564,600 |

11,411,500 |

36% |

|

|

11,411,500 |

0 |

39% |

|

|

India |

0 |

1,095,720 |

0% |

|

1,095,720 |

2,191,440 |

5% |

|

|

2,191,440 |

3,287,160 |

10% |

|

|

3,287,160 |

4,382,880 |

15% |

|

|

4,382,880 |

5,478,600 |

20% |

|

|

5,478,600 |

30% |

||

Sources