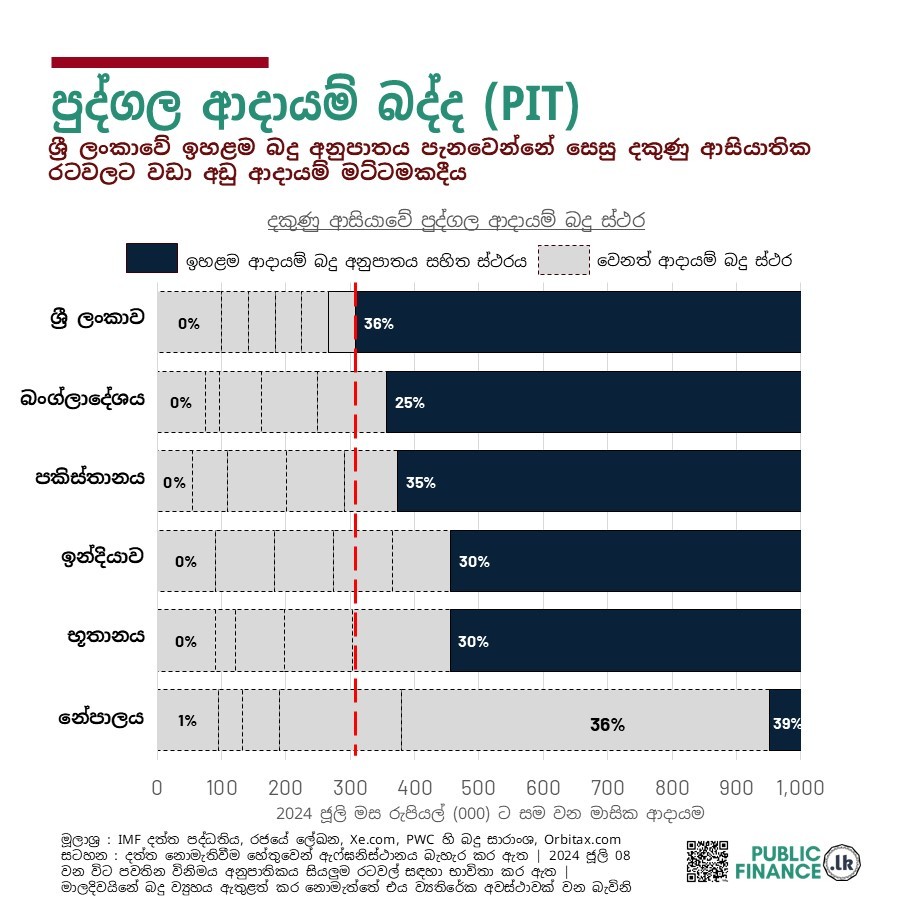

ශ්රී ලංකාවේ පුද්ගල ආදායම් බදු ව්යුහය දකුණු ආසියාතික කලාපයේ සෙසු රටවල් සමඟ සංසන්දනය කිරීමේදී ප්රධාන කරුණු තුනක් අනාවරණය වේ:

1. ශ්රී ලංකාව, මෙම කලාපයේ ඉහළම බදු රහිත ආදායම ඇති රට වේ. බදු රහිත ආදායම යනු බදු පැනවීම ආරම්භ වන අවම ආදායම් මට්ටමයි.

2. ශ්රී ලාංකිකයින් හට ඉහළම බදු අනුපාතය–එනම්, බදු උපලේඛනයේ ඇතුළත් ඉහළම ආදායම් බදු අනුපාතය– පැනවෙනු ලැබෙන්නේ අනෙකුත් දකුණු ආසියාතික රටවලට සාපේක්ෂව අඩු ආදායමකදීය.

3. ශ්රී ලංකාවේ බදු බර වඩා අඩු ආදායම් මට්ටම් සඳහා (මසකට රුපියල් 250,000 ට අඩු ආදායමක් ලබන පුද්ගලයින්) කලාපයේ සෙසු රටවලට සාපේක්ෂව අඩු වන නමුත්, වඩා ඉහළ ආදායම් මට්ටම් (රුපියල්. 250,000 ට වැඩි ආදායමක් උපයන පුද්ගලයින්) සඳහා එය සාපේක්ෂව ඉහළ අගයක් ගනී.

පසුබිම

පුද්ගල ආදායම් බදු මගින් එකතු කරනු ලබන ආදායම ඉහළ නැංවීමේ අරමුණින් ශ්රී ලංකාව විසින් 2022 අංක 45 දරන දේශීය ආදායම් (සංශෝධන) පනත මගින් 2023 දී සිය පුද්ගල ආදායම් බදු ව්යුහය ප්රතිසංස්කරණය කරන ලදි. බදු රහිත සීමාව රුපියල් මිලියන 3.0 ක (මසකට රු. 250,000) වාර්ෂික ආදායමක සිට රුපියල් මිලියන 1.2 දක්වා (මසකට රු. 100,000) අඩු කිරීම සහ බදු ස්ථරවල විශාලත්වය රුපියල් මිලියන 3.0 ක වාර්ෂික ආදායමේ සිට රුපියල් 500,000 දක්වා අඩු කිරීම මෙම ප්රතිසංස්කරණවලට ඇතුළත් විය. එමෙන්ම, මීට පෙර උපරිම බදු අනුපාතය 18% ක් වූ අතර එය 36% දක්වා ඉහළ නැංවීම ද මෙම ප්රතිසංස්කරණ මගින් සිදු කරන ලදි.

එහි ප්රතිඵලයක් ලෙස, 2022 දී රුපියල් බිලියන 49.5 ක් ලෙස පැවති පුද්ගල ආදායම් බදු ආදායම 2023 දී සිව් ගුණයකින් වැඩි වී රුපියල් බිලියන 193.5 දක්වා ඉහළ ගියේය.

ශ්රී ලංකාවේ වර්තමාන පුද්ගල ආදායම් බදු ව්යුහය අංක 1 වගුවෙහි දක්වා ඇත.

1 වගුව: 2024 සැප්තැම්බර් වන විට පුද්ගල ආදායම් බදු උපලේඛනය

|

වාර්ෂික ආදායම |

මාසික ආදායම |

|

||

|

පහළ සීමාව |

ඉහළ සීමාව |

පහළ සීමාව |

ඉහළ සීමාව |

බදු අනුපාතය (%) |

|

0 |

1,200,000 |

- |

100,000 |

0% |

|

1,200,000 |

1,700,000 |

100,000 |

141,667 |

6% |

|

1,700,000 |

2,200,000 |

141,667 |

183,333 |

12% |

|

2,200,000 |

2,700,000 |

183,333 |

225,000 |

18% |

|

2,700,000 |

3,200,000 |

225,000 |

266,667 |

24% |

|

3,200,000 |

3,700,000 |

266,667 |

308,333 |

30% |

|

3,700,000 |

|

308,333 |

- |

36% |

මූලාශ්රය : ශ්රී ලංකාවේ දේශීය ආදායම් දෙපාර්තමේන්තුව, https://www.ird.gov.lk/en/sitepages/default.aspx [2024 සැප්තැම්බර් 3 අවසන් වරට ප්රවේශ විය].

ශ්රී ලංකාවේ විශාල බදු රහිත ආදායම් සීමාව

මාලදිවයින හැරුණු විට දකුණු ආසියාවේ ඉහළම බදු රහිත ආදායම් සීමාවට හිම්කම් කියන්නේ ශ්රී ලංකාවයි. තම වාර්ෂික ආදායම රුපියල් මිලියන 1.2 (මසකට රුපියල් 100,000) ඉක්ම වන්නේ නම් මිස මෙරට පුරවැසියන් ආදායම් බදු ගෙවීමෙන් නිදහස් කර තිබේ. මීට සාපේක්ෂව, අසල්වැසි රටවල් විසින් පනවා ඇත්තේ වඩා අඩු බදු රහිත සීමාවන් වේ. නිදසුනක් වශයෙන්, බංග්ලාදේශයේ මාසික බදු රහිත සීමාව ආසන්න වශයෙන් ශ්රී ලංකා රුපියල් 75,682 ට සම වන අතර පකිස්තානයේ එය ශ්රී ලංකා රුපියල් 54,710 ට සම වේ. ඉන්දියාව සහ භූතානය ශ්රී ලංකාවට වඩා මඳක් අඩු, එනම් ශ්රී ලංකා රුපියල් 91,000 කට පමණ සම වන බදු රහිත සීමාවක් පනවා ඇත. කිසිදු බදු රහිත සීමාවක් නොපනවා, අඩුම ආදායම් මට්ටම් සඳහා පවා 1% ක බද්දක් පනවන නේපාලය මෙහිදී ව්යතිරේකයකි. ශ්රී ලංකාවේ විශාල බදු රහිත ආදායම හේතුවෙන් එය මෙම කලාපයේ රටවල් අතර බදු ගෙවන්නන්ට– අඩුම තරමින් බදු ගෙවීමෙන් නිදහස් කර ඇති, ආදායම වඩා අඩු පුද්ගලයින්ට හෝ–වඩාත් හිතකාමී රටක් වේ.

ශ්රී ලංකාව ඉහළම බදු අනුපාතය වෙත ඉක්මණින් ළඟා වේ

ශ්රී ලංකාව, අනෙකුත් දකුණු ආසියාතික රටවලට සාපේක්ෂව වඩා අඩු ආදායම් සීමාවකදී සිය ඉහළම බදු අනුපාතය පනවයි. රුපියල් 308,333 ඉක්මවන මාසික ආදායමක් සහිත පුද්ගලයින් 36% ක අතිශයින් ඉහළ බදු අනුපාතයකට යටත් වන අතර, මෙමගින් ශ්රී ලංකාව දකුණු ආසියාතික රටවල් අතරින් ඉහළම ආදායම් බදු ස්ථරයට–එනම්, ආදායම මත පැනවෙන ඉහළම බදු අනුපාතය–වේගයෙන්ම ළඟා වන රට බවට පත් වේ.

මීට සාපේක්ෂව, ඉන්දියාව සහ භූතානය පිළිවෙලින් රුපියල් 457,000 සහ රුපියල් 456,000 ක පමණ ආදායම් සඳහා 30% ක ඉහළම බදු අනුපාතය පනවන අතර, පකිස්තානය රුපියල් 374,000 ට වැඩි ආදායම් සඳහා තම ඉහළම අනුපාතය වන 35% ක අනුපාතය පනවයි. ඉහළම බදු අනුපාතය 25% ක් වශයෙන් වඩා අඩු අගයක් නියම කර ඇති බංග්ලාදේශය රුපියල් 357,000 ඉක්මවන ආදායම් සඳහා එය පනවයි. ශ්රී ලංකාවට වඩා වැඩි උපරිම බදු අනුපාතයක් පනවා ඇති එකම රට වන නේපාලය, රුපියල් 950,958 ට වැඩි ආදායම් සඳහා 39% ක බද්දක් පනවන අතර එහි 36% අනුපාතය රුපියල් 381,000 ට වැඩි ආදායම්වලට අදාළ වේ—නමුත්, එම සීමාව ද ශ්රී ලංකාවේ සීමාවට වඩා ඉහළ අගයක් ගනී.

වඩා අඩු හා වඩා ඉහළ ආදායම් මට්ටම් මත පැනවෙන බදු බර අතර පවතින විෂමතාව

මෙම විශ්ලේෂණය තුළින් ශ්රී ලංකාවේ පුද්ගල ආදායම් බදු බරෙහි සුවිශේෂී රටාවක් ඉස්මතු කෙරේ. එනම්, ශ්රී ලංකාවේ බදු බර සැලකූ විට, වඩා අඩු ආදායම් මට්ටම් සහ වඩා ඉහළ ආදායම් මට්ටම් මත පැනවෙන බදු බර අතර සැලකිය යුතු වෙනසක් පවතී. වඩා අඩු ආදායම් මට්ටම්වලදී, එනම්, විශේෂයෙන්ම මසකට රුපියල් 250,000 ට වඩා අඩු ආදායමක් ලබන පුද්ගලයින් මත පැනවෙන බදු බර (තම ආදායමෙන් බදු වශයෙන් ගෙවනු ලබන ප්රතිශතය ලෙස බදු බර ගණනය කළ විට) අනෙකුත් දකුණු ආසියාතික රටවලට සාපේක්ෂව අඩු වේ. නිදසුනක් වශයෙන්, ශ්රී ලංකාවේ රුපියල් 150,000 ක් උපයන පුද්ගලයින් බදු වශයෙන් ගෙවන්නේ ඔවුන්ගේ ආදායමෙන් 2% ක් පමණක් වන අතර, මාලදිවයින ඇතුළු අනෙකුත් දකුණු ආසියානු රටවල් සඳහා මෙහි සාමාන්යය 4% කි. කෙසේ වෙතත්, මෙම ආදායම් මට්ටමෙන් ඔබ්බට, ශ්රී ලංකාවේ බදු බර තියුණු ලෙස ඉහළ යයි. මසකට රුපියල් 250,000 ට වැඩි ආදායම් මට්ටම් සඳහා ශ්රී ලංකාවේ බදු බර කලාපයේ සෙසු රටවලට සාපේකෂව වේගයෙන් ඉහළ යන අතර එය දකුණු ආසියාවේ එම ආදායම් මට්ටම් සඳහා ඉහළම බදු බරක් ඇති රටවල්වලින් එකකි. රුපියල් 500,000 ක ආදායම් මට්ටමකදී 21% දක්වා ළඟා වන ශ්රී ලංකාවේ බදු බර දකුණු ආසියාවේ සාමාන්යය වන 15% හා සසඳන විට වඩා ඉහළ අගයකි. කෙසේ වෙතත්, මෙය පකිස්තානයේ (22%) සහ නේපාලයේ (23%) බදු බරට වඩා මඳක් අඩු මට්ටමක පවතී.

මේ අනුව, මෙරට ක්රියාත්මක වන පුද්ගල ආදායම් බදු ක්රමය හේතුවෙන් ශ්රී ලංකාව දකුණු ආසියාව තුළ විශේෂ්ය වූ ස්ථානයක් හිමි කර ගෙන තිබේ. එක් පසෙකින් ශ්රී ලංකාව තම ඉහළ බදු රහිත සීමාව තුළින් අඩු ආදායම්ලාභීන්ට සැලකිය යුතු සහනයක් ලබා දෙන අතරම, අනෙක් පසින් එය අසල්වැසි රටවලට වඩා වැඩි වේගයකින් ඉහළ ආදායම් ලබන්නන් මත දැඩි බදු බරක් පනවයි.

විශ්ලේෂණය සඳහා භාවිතා කර ඇති ක්රමවේදය පිළිබඳ සටහන

අතිරේක වගු

වගුව 1: දකුණු ආසියාවේ බදු රහිත ආදායම් සීමාව (දේශීය මුදල් සහ ශ්රී ලංකා රුපියල්වලින් (LKR) ඊට සම වන අගයන්)

|

රට |

දේශීය ව්යවහාරික මුදලින් වාර්ෂික බදු රහිත සීමාව |

දේශීය ව්යවහාරික මුදලින් මාසික බදු රහිත සීමාව |

ශ්රී ලංකා රුපියල්වලින් මාසික බදු රහිත සීමාව |

|

ශ්රී ලංකාව |

LKR 1,200,000 |

LKR 100,000 |

LKR 100,000 |

|

බංග්ලාදේශය |

BDT 350,000 |

BDT 29,167 |

LKR 75,682 |

|

පකිස්තානය |

PKR 600,000 |

PKR 50,000 |

LKR 54,710 |

|

ඉන්දියාව |

INR 300,000 |

INR 25,000 |

LKR 91,310 |

|

භූතානය |

BTN 300,000 |

BTN 25,000 |

LKR 91,107 |

|

නේපාලය |

0 |

0 |

0 |

|

මාලදිවයින |

MVR 720,000 |

MVR 60,000 |

LKR 1,183,248 |

වගුව 2: දකුණු ආසියාවේ වාර්ෂික බදු අනුපාත උපලේඛන (දේශීය ව්යවහාරික මුදල් සහ ශ්රී ලංකා රුපියල්වලින් (LKR) ඊට සම අගයන්)

|

රට |

ආදායම් කාණ්ඩය (ශ්රී ලංකා රුපියල්වලට හරවා) |

බදු අනුපාතය (%) |

|

|

පහළ ආදායම් සීමාව |

ඉහළ ආදායම් සීමාව |

||

|

බංග්ලාදේශය |

0 |

908,180 |

0% |

|

908,180 |

1,167,660 |

5% |

|

|

1,167,660 |

1,946,100 |

10% |

|

|

1,946,100 |

2,984,020 |

15% |

|

|

2,984,020 |

4,281,420 |

20% |

|

|

4,281,420 |

|

25% |

|

|

පකිස්තානය |

0 |

656,520 |

0% |

|

656,520 |

1,313,040 |

5% |

|

|

1,313,040 |

2,407,240 |

15% |

|

|

2,407,240 |

3,501,440 |

25% |

|

|

3,501,440 |

4,486,220 |

30% |

|

|

4,486,220 |

|

35% |

|

|

මාලදිවයින |

0 |

14,198,976 |

0% |

|

14,198,976 |

23,664,960 |

6% |

|

|

23,664,960 |

35,497,440 |

8% |

|

|

35,497,440 |

47,329,920 |

12% |

|

|

47,329,920 |

|

15% |

|

|

භූතානය |

0 |

1,093,287 |

0% |

|

1,093,287 |

1,457,716 |

10% |

|

|

1,457,716 |

2,368,789 |

15% |

|

|

2,368,789 |

3,644,290 |

20% |

|

|

3,644,290 |

5,466,435 |

25% |

|

|

5,466,435 |

|

30% |

|

|

නේපාලය |

0 |

1,141,150 |

1% |

|

1,141,150 |

1,597,610 |

10% |

|

|

1,597,610 |

2,282,300 |

20% |

|

|

2,282,300 |

4,564,600 |

30% |

|

|

4,564,600 |

11,411,500 |

36% |

|

|

11,411,500 |

0 |

39% |

|

|

ඉන්දියාව |

0 |

1,095,720 |

0% |

|

1,095,720 |

2,191,440 |

5% |

|

|

2,191,440 |

3,287,160 |

10% |

|

|

3,287,160 |

4,382,880 |

15% |

|

|

4,382,880 |

5,478,600 |

20% |

|

|

5,478,600 |

|

30% |

|

මූලාශ්ර