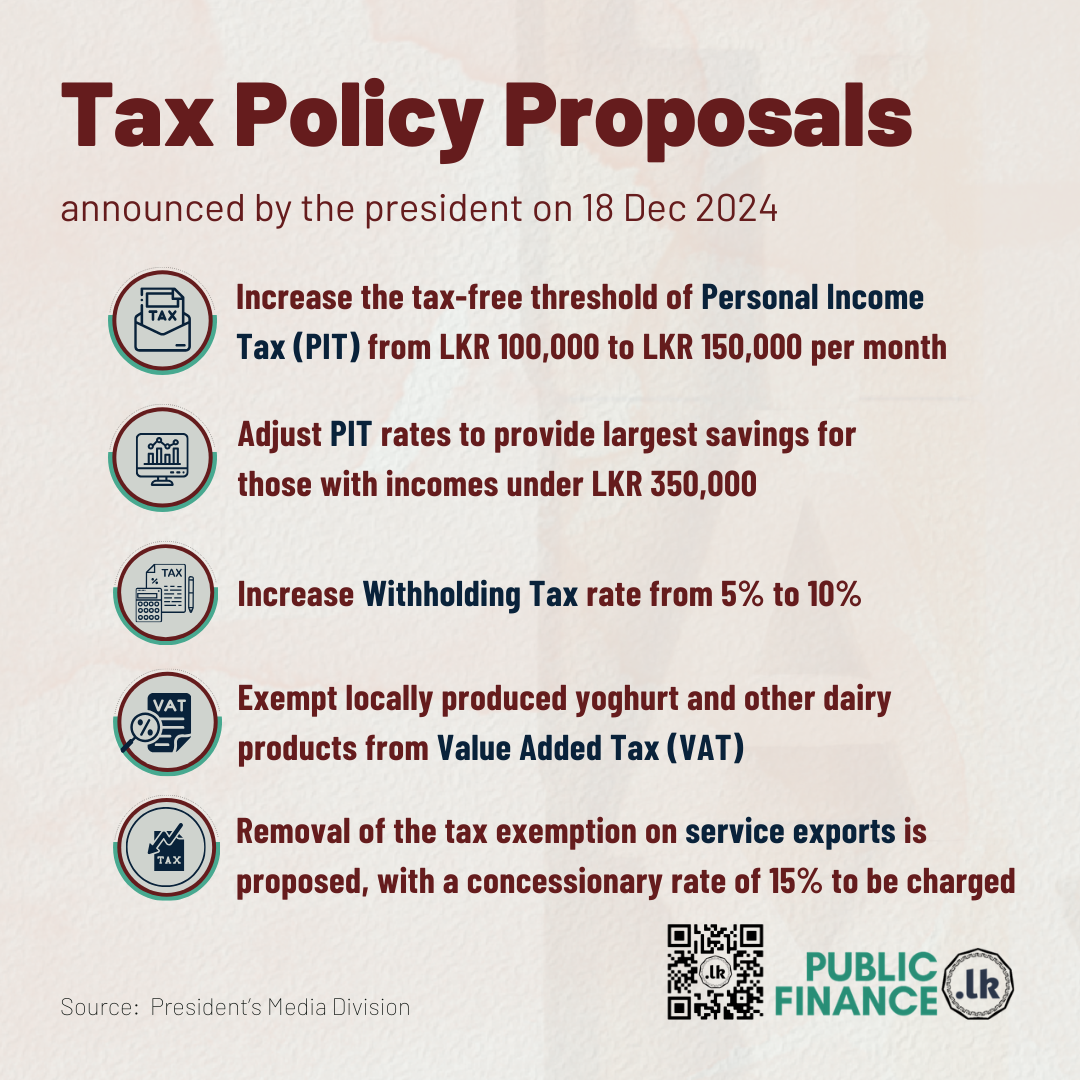

In his parliamentary speech on December 18, 2024, the President announced key tax policy changes:

Personal Income Tax (PIT): The tax-free threshold will be increased from LKR 100,000 to LKR 150,000.

Personal Income Tax (PIT): Adjust PIT rates to provide largest savings for those with incomes under LKR 350,000. The table below shows the percentage of tax savings due to this change for an individual earning the different income levels.

|

Monthly Income (LKR) |

Tax Savings (%) |

|

150,000 |

100 (no tax) |

|

200,000 |

71 |

|

250,000 |

61 |

|

300,000 |

47 |

|

350,000 |

25.5 |

Withholding Tax (WHT): The rate will be increased from 5% to 10%.

VAT Exemptions: Locally produced yogurt and other dairy products will be exempted from Value Added Tax (VAT).

Tax on export of services: The tax exemption will be removed, and a concessionary rate of 15% is proposed to be charged.

It is worth noting that Verité Research has advocated for increasing the Withholding Tax (WHT) to 10% to promote fairness and efficiency in Sri Lanka's tax system.

To explore our recommendations on WHT, visit: https://lnkd.in/gSHcrC_q, and watch the full video on our YouTube channel: https://lnkd.in/gbdTFa6t.

Source

President’s Media Division, 'Will Ensure That the 2022-23 Crisis Never Recurs in Our Country', at https://pmd.gov.lk/news/will-ensure-that-the-2022-23-crisis-never-recurs-in-our-country/ [last accessed 19 December 2024].